Globalization, multichannel marketing, supply-chain management, strategic alliances, regulations, corporate governance — marketing is riskier today than ever. To put their companies at competitive advantage, marketers need to take more calculated risks. Yet to most marketing departments, "risk management" is limited to customer credit and vetting vendors — functions usually handled by finance or purchasing.

For marketing executives, risk management is a trial-and-error evolution. Has this agency produced good work previously? Will this vendor deliver on time? Experience has fine-tuned our instincts to a point where we intuitively assess risks based upon a combination of hundreds of deliberately and subconsciously collected data points.

Many executive committee members still view marketing as the last bastion of significant risk exposure. Everyone else from finance to operations, HR to IT employs robust risk-assessment tools and processes and highly effective ways to demonstrate the risk-adjusted outcomes of their key projects. They talk in terms of "net present value" of "future returns" associated with an investment made today. They link their recommendations to the bottom line and present their cases in such a way as to reassure not just the CEO, but also their peers, that they have carefully analyzed the financial, operational, organizational, and environmental risks and are proposing the optimal solution with the best likely outcome.

This process needs to be carried into the marketing measurement platform. Each proposed initiative or program should be evaluated not just on its total potential return, but on its risk-adjusted potential.

Here’s an example: Let’s say we’re a retailer planning a holiday sale. We plan to run $1 million of TV advertising to drive traffic into stores during this one-day extravaganza. Using the reach and frequency data we get from our media department, combined with our assessment of the likely impact of the advertising copy, we estimate that about one million incremental customers will visit our stores on that day. If only 5% of them purchase at our average gross-margin per transaction of $20, we break even, right?

Unless, of course, it rains. In that case, our media will reach far more people watching TV inside, but far fewer will venture out to shop. Or maybe the weather will be fine, but one of our competitors will simultaneously announce a major sale event of their own featuring some attractive loss-leaders to entice traffic into their stores. Or maybe there will be some geopolitical news event that disturbs the normal economic optimism of our customers, causing them to cancel or postpone buying plans for a while.

Any or all of these things could happen. It only takes one to completely mess up the projected return on the $1 million investment in sale advertising.

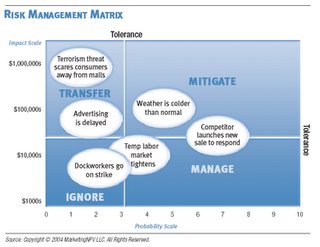

A strong measurement framework requires that each marketing initiative be thoroughly risk-assessed to identify all the bad things that could happen, the likelihood of them happening, and the potential impact if they did. The project forecast is then reduced accordingly. So if rain would cause a 50% drop in estimated store traffic and the weather forecast shows a 30% probability of rain in the area, our forecast for the event should be reduced by 15% (50% x 30%).

This structured risk-assessment approach will highlight investments that are more prone to external risk factors and modify their rosy expectations accordingly. In the end, high-risk, high-reward initiatives may be just what’s required to achieve business goals, but wouldn’t you rather know that’s what you are approving, instead of finding it out later when high hopes are dashed?

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment