Channel Coverage

If you’re selling wireless phones through independent retailers, you’ll want to make sure you’re covering all the places where people are buying those phones. Companies that manage their distribution chains contractually — through independent agents, sales representatives, or other partners that help them get business done — can get clarity on prospect reach and market penetration from a dashboard metric on this issue. It can be even more forward-looking if coverage incorporates prospective channel partners in various stages of finalizing agreements and building out facilities.

Channel Relationship Mix

With the level of decentralization and outsourcing in business today, companies may not have full control over the players who staff their distribution channels downstream. Major oil companies like Shell and ExxonMobil don’t manage every stop on their distribution chains anymore, but they still have to keep track of how their products are selling at the consumer level. Monitoring the evolving mix of channel relationship types helps to keep the focus on the strategic importance of channel leverage strategies.

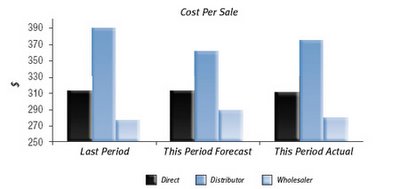

Relative Channel Performance

When you have multiple types of channels, you can often structure ways to look at marketing returns by channel — which gives you a view toward opportunities to optimize investments across channels. You might, for example, find that the cost-per-sale in one channel is significantly lower than the others. This raises the question of how much more money could be spent in selling through that channel before the returns begin to diminish (an optimization challenge). Monitoring these relative channel performance measures can provoke key questions about how resources are being allocated and help forecast the need for revitalizing efforts or planning capital investments.

Channel Stock Positions

Stock-outs can be a critically limiting factor to growth. Customers get annoyed when they go out of their way to come in only to find you’re out of something they think you should have. The loss can be permanent. If monitoring and forecasting in- and out-of-stock ratios is crucial to your business, then it’s relevant for your dashboard. The forward-looking component of this measurement relies on good sales forecasting to help you spot problems with your inventory before they happen. It can also help you better manage the range of merchandise you carry and watch your inventory turns more closely.

Channel Perceptions of Marketing

There’s been very little dashboard activity in this area to date, but this is a measurement category worthy of careful consideration. Many of the same companies that spend millions on research to understand customer and employee views spend nothing on capturing channel perspectives. This is not only crucial to businesses like fast food franchisors and automobile manufacturers who must coordinate local marketing activity with regional co-ops of franchisees, but can be equally important to manufacturers of all types selling through Lowe’s, Target, or other retailers for which the opinions of the category buyers and the sales floor associates can make or break marketing effectiveness. It’s also important to industries that distribute through agent networks, wholesalers, or independent sales organizations.

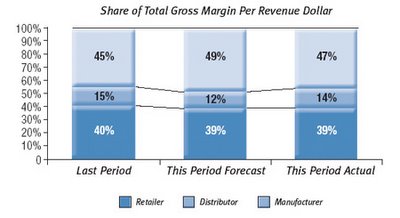

Channel Power Measures

There are a number of different ways you can measure channel power, but the most compelling is how much margin you’re keeping vs. your channel partners. If the markup to the final consumer is greater than the wholesale markup, it stands to reason that you have ceded some significant power to the channel. Reclaiming some of that margin is a worthy pursuit for marketing and monitoring and forecasting channel power gives you some sense of how effective you are at changing bottom-line performance through brand building or product innovation.

These are just a few examples of how you might better reflect channel performance in your business and manage towards target goals. The old saying that "if you can't measure it, you can't manage it" might never have been more true than with respect to channel management.

1 comment:

I am writing about channel sales strategy, and your site has been one of my sources. Thank you for such great insights.

The metrics you have stated in your article are all important in keeping tabs of partner performance. I totally agree with the Channel relationship mix argument. One could easily get lost in the whole relationship mix but as long as you have metrics to keep everyone grounded on the strategy, conflict can be identified proactively.

Post a Comment